Kids Corner: Understanding Divorce

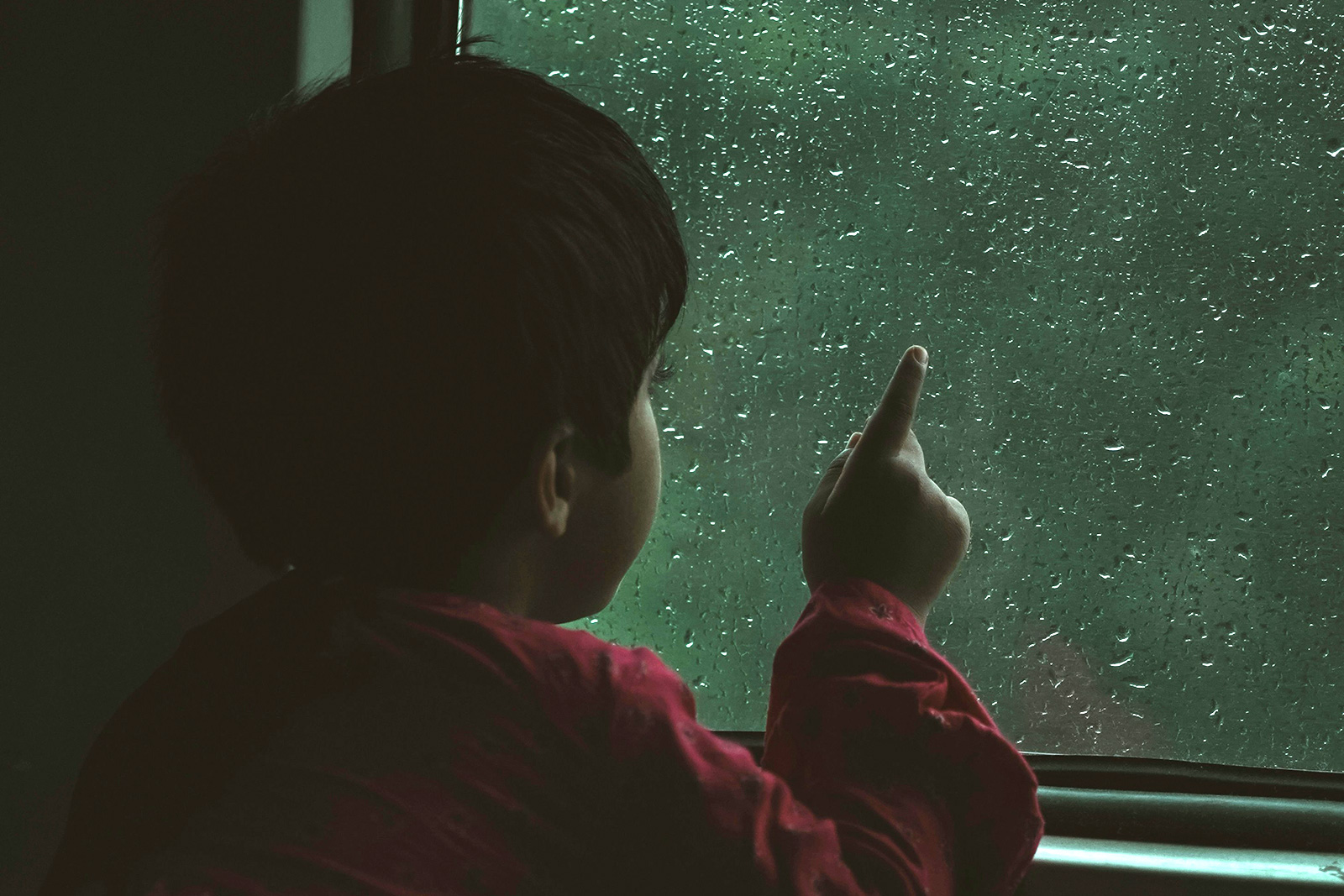

Divorce can be a confusing and emotional experience for children. It’s important for kids to know that while divorce means their parents are no longer together, they are still loved and cared for just as much as before.