What is Plaid?

Plaid is a technology service that securely connects your financial accounts – like checking, savings, credit cards, and investments – to apps and platforms you trust. It powers financial services for over 8,000 apps, 100+ million users, and 12,000+ financial institutions, including companies like Venmo, Rocket Mortgage, and American Express.

When used with Onward, Plaid allows you to share just the financial data needed for divorce, quickly, securely, and without having to dig through stacks of statements.

How Onward Uses Plaid to Simplify Divorce Disclosures

Connecting your accounts with Plaid makes completing your disclosures faster, easier, and more accurate. Here’s how:

1. Click & Connect

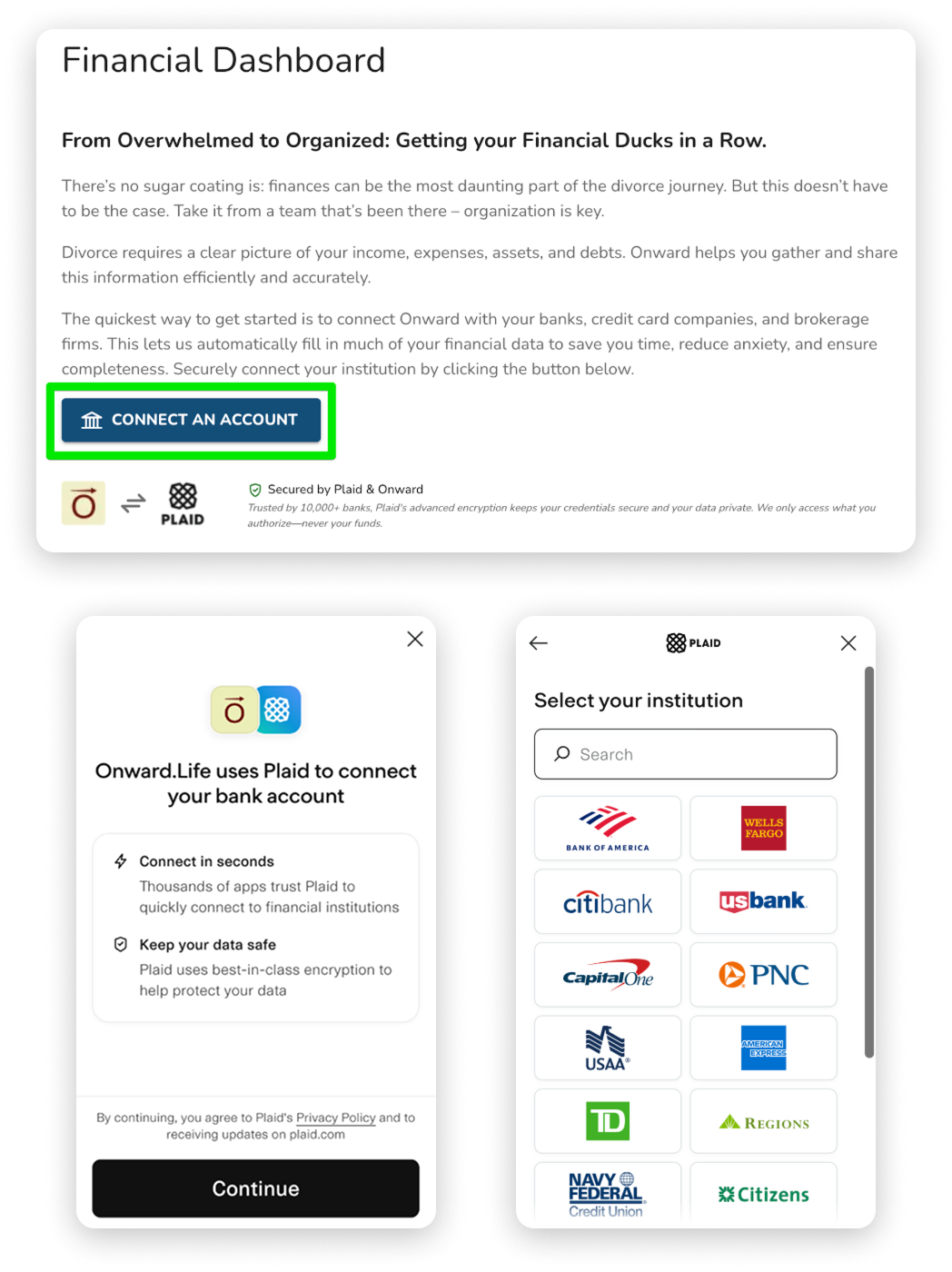

From your Onward Financial Dashboard, click “Connect an Account.” You’ll be securely redirected to Plaid’s interface, where you’ll see their familiar logo and a list of financial institutions.

2. Authenticate Securely

Choose your bank, credit union, or financial institution from the list provided.You’ll be prompted to log in to your bank using your online banking username and password. Complete any required multi-factor authentication such as OTPs (One Time Passcodes). Your credentials are always encrypted and never viewed by or shared with Onward.

You’ll be able to select exactly which accounts to connect, such as checking, savings, or credit cards. You can also disconnect access at any time.

3. See Results Instantly

Once connected, your account data flows directly into Onward. You’ll see:

- Real-time account balances

- Recent transactions

- Categorized expenses (like “Groceries,” “Housing,” or “Utilities”)

- Everything is presented in a clean, organized format to get ready for legal review, negotiations, or court filings.

Benefits of Using Plaid with Onward for Divorce

✅ Faster, more accurate disclosure

No more manual entry or spreadsheet juggling. Onward organizes your data for you.

✅ Stay in control of your data

You choose which accounts to share. You can disconnect at any time.

✅ Reduce errors and stress

Less back-and-forth with your lawyer or spouse. More clarity on what’s been disclosed.

✅ Create a trustworthy paper trail

Each transaction is timestamped and traceable, which helps resolve disputes and build trust with attorneys, mediators, and the court.

What Kind of Data Is Shared?

Using Plaid with Onward gives you the option to securely share:

- Bank account balances

- Recent transactions

- Account names and types

- Nothing beyond what’s needed for your disclosure is collected, and you can control the access at all times.

Why You Can Trust Plaid

Security and transparency are core to how Plaid operates. Here’s what makes them reliable:

- Used by 12,000+ banks and financial institutions

- Powers apps used by over 100 million people

ISO 27001, ISO 27701, and SOC 2 certified meeting the highest global security standards - Built on the principle that you own your financial data

How Onward + Plaid Streamline Your Divorce Process

Here’s what happens when you connect your accounts through Onward:

- Your financial tasks populate automatically, including balances and expenses

- Transactions are auto-categorized (e.g. “Mortgage”, “Groceries”, “Entertainment”) for easier tracking

- You get a clear financial snapshot with total assets, liabilities, and income, all in one place

- All records are timestamped giving you a clear audit trail

- You’ll spend less time digging through paperwork and more time focusing on the decisions that matter most.

Key Takeaways

- Financial disclosure is a required part of divorce and accuracy matters

- Plaid helps you connect your accounts securely and share only what’s needed

- Onward uses this data to automatically build a clear, court-ready financial profile

- You stay in control the entire time, with full transparency and security